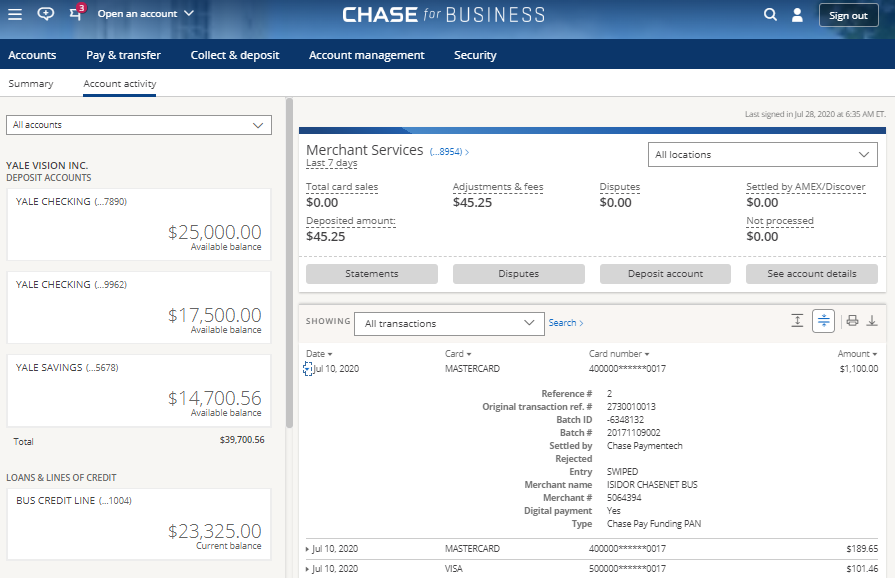

Getting hit with chargebacks can also cause issues with the merchant’s relationship with the credit card issuers. Merchants get penalized when they are hit the chargebacks and have to pay fees and hassle with a lot of paperwork. One of the major reasons why you want to try to resolve the issue with the merchant directly is because it just makes things easier for everybody involved. It’s free and will help you optimize your rewards and savings!īefore you ever contact Chase to initiate the dispute process, you should try to contact the merchant directly and resolve the issue. Tip: Use WalletFlo for all your credit card needs. If you’re dealing with a small business credit card such as the Chase Ink Business Preferred, I suggest calling the number on the back of your credit card. Note that this article will focus on personal Chase cards, such as the Chase Sapphire Preferred, Chase Sapphire Reserve, and other Chase co-branded credit cards. To initiate a claim over the phone just call the phone number on the back of your card Monday through Friday from 7 AM to 10 PM Eastern time, and Saturday and Sunday from 9 AM to 8 PM Eastern time. You can send in your dispute to the following address:įax to: 1-88 Attn: Cardmember Services – Dispute Resolution Phone To file a dispute online, simply log-in to your account and follow the steps below. You can dispute a Chase charge in a few ways: online, by mail, fax, or even over the phone.

#Chase dispute charge greater than 6 months ago how to#

How to dispute a Chase credit card charge How to dispute a Chase credit card charge.

0 kommentar(er)

0 kommentar(er)